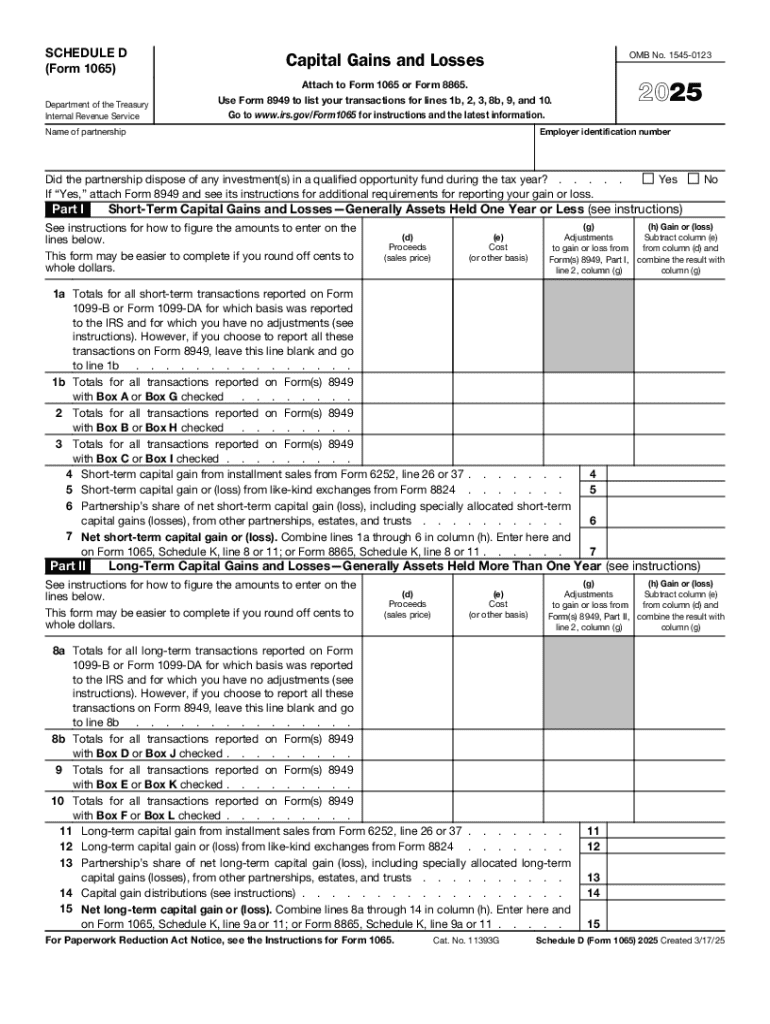

IRS 1065 - Schedule D 2025-2026 free printable template

Instructions and Help about IRS 1065 - Schedule D

How to edit IRS 1065 - Schedule D

How to fill out IRS 1065 - Schedule D

Latest updates to IRS 1065 - Schedule D

All You Need to Know About IRS 1065 - Schedule D

What is IRS 1065 - Schedule D?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1065 - Schedule D

What should I do if I discover an error after filing my IRS 1065 - Schedule D?

If you find an error after submitting your IRS 1065 - Schedule D, you should file an amended return using the appropriate IRS form. Ensure you provide a clear explanation of the corrections made. Keep in mind that timely submission of corrections can help avoid potential penalties.

How can businesses track the status of their submitted IRS 1065 - Schedule D?

Businesses can track the status of their IRS 1065 - Schedule D by accessing the IRS online tools or contacting the IRS directly. Common e-file rejection codes are available that indicate specific issues, and it's crucial to address those promptly to ensure proper processing.

What could cause my e-filed IRS 1065 - Schedule D to be rejected?

Your e-filed IRS 1065 - Schedule D may be rejected due to errors such as incorrect taxpayer identification numbers, mismatched details with IRS records, or missing required fields. Review the rejection notice carefully to identify the specific issue and make necessary corrections before resubmitting.

Are electronic signatures accepted for IRS 1065 - Schedule D filings?

Yes, electronic signatures are accepted for IRS 1065 - Schedule D filings, provided that the e-filing software complies with IRS standards. Keep records of the signed documents as part of the e-filing process to ensure compliance with IRS regulations.

What is the recommended record retention period for IRS 1065 - Schedule D documents?

It is advisable to retain records related to your IRS 1065 - Schedule D for at least three years from the date of filing. This retention period is essential to support your tax return in case of an audit or any inquiries from the IRS.